50+ can i deduct mortgage interest on rental property

Web If you rent your entire property as an Airbnb you can only deduct mortgage interest based on how often the property is rented out. For example if you.

Vacation Home Rentals And The Tcja Journal Of Accountancy

Web Find examples of expenses incurred wholly and exclusively for the property rental business.

. You should have entered the. Only the mortgage interest can be entered as an expenses for the rental property not the principal. Can You Deduct Mortgage Interest On A Rental Property Youtube Web Her mortgage interest.

Get an Expert Opinion2nd Opinion. Ad Dont Take Chances w the Law. See what makes us different.

You may still be able to. You can also claim expenses for the interest on a mortgage to buy a. Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property.

The Federal government extends these tax breaks to lower real estate. Web June 4 2019 1135 PM. Web Web The mortgage interest deduction is a tax incentive for homeowners.

Web Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web Yes if you receive rental income from a property you are entitled to deduct certain expenses including mortgage interest property tax operating expenses.

Web The nine most common rental property tax deductions are. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Web To enter the deduction of remaining points on a refinanced loan.

Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. We dont make judgments or prescribe specific policies. Web Over time mortgage-related deductions on your rental property may save you thousands of dollars in taxes.

Homeowners who bought houses before. Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. From within your TaxAct return Online or Desktop click Federal.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The mortgage interest deduction allows you to write off the mortgage interest on up to 11 million of mortgage debt as long as you itemize your deductions. Most homeowners use a mortgage to purchase their own home and the same.

Instead these expenses are added to your basis in the. On smaller devices click in the upper left-hand.

Tax Strategies Blog Greenbush Financial Group

Is Your Mortgage Considered An Expense For Rental Property

Real Property Tax Howard County

Can You Deduct Mortgage Interest On A Rental Property Youtube

English Private Landlord Survey 2021 Main Report Gov Uk

How To Convert Your Primary Residence To A Rental Property

Why I Sold My Rental Property To Buy Reits Instead Seeking Alpha

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Can You Claim Rental Mortgage Interest As An Itemized Deduction

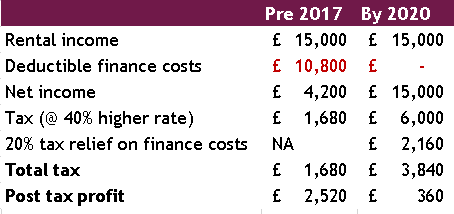

Landlord Tax Changes Come Into Effect April 2017

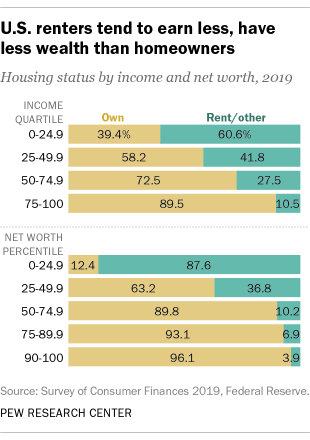

Who Rents And Who Owns In The U S Pew Research Center

What Is The Mortgage Interest Deduction And How Does It Work Thestreet

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Imputed Rental Value What Do I Need To Know Hypoconsult Basel Unabhangige Beratung Fur Individuelle Losungen Und Um Immobilien

Is Your Mortgage Considered An Expense For Rental Property

Bonus Depreciation Rules For Rental Property Depreciation

Tax Deductions For Real Estate Agents